Introduction

When it comes to freelancing, the idea of commanding a high day rate often evokes thoughts of financial prosperity. Engineers, in particular, are frequently drawn to the allure of freelancing, while employers express concerns about the perceived costliness of hiring freelancers. However, as someone who has experienced the freelance world firsthand, I can confidently say that the reality is quite different. In this blog post, we will delve into the reasons why a seemingly substantial day rate may not necessarily translate into wealth, and explore the factors that often go unnoticed.

The Missing Benefits

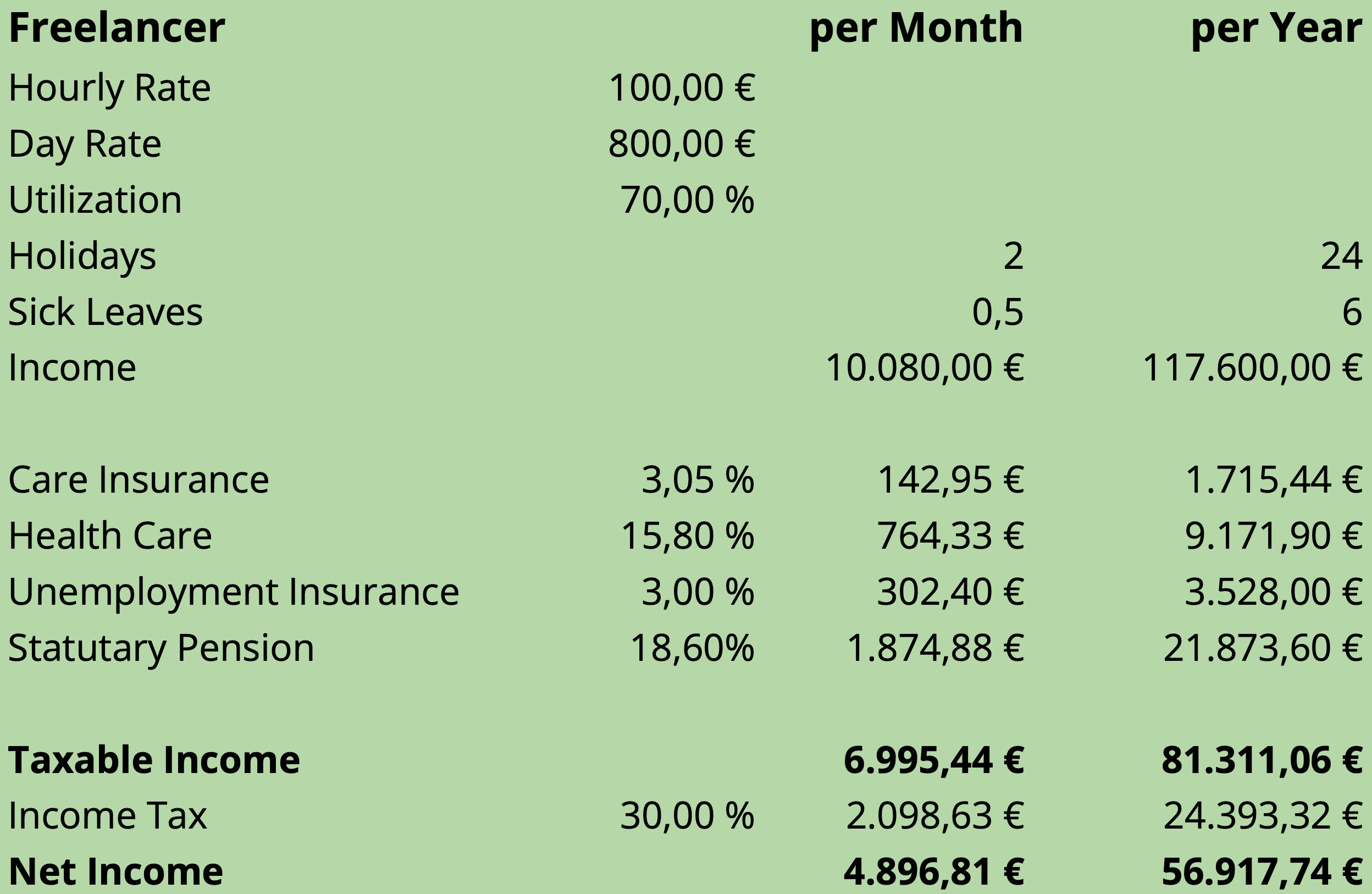

One crucial aspect that is often overlooked is the disparity in benefits between permanent employees and freelancers. In Germany, for example, permanent employees enjoy paid holidays and sick leave, whereas freelancers do not. Typically, employees in Germany receive around 20-30 days of paid holidays each year. Moreover, freelancers do not receive any payment during sick leaves, and if you have dependents, you may be unable to work and invoice when they fall ill. These factors can significantly impact a freelancer's earnings and financial stability.

Burdens of Social Security Expenses

Another aspect that often catches freelancers off guard is the responsibility of covering social security expenses. In Germany, employers cover half of the expenses for healthcare and pension contributions. However, as a freelancer, you are solely responsible for these costs, which can amount to approximately 16% for healthcare and 19% for pension contributions based on your income. These expenses can eat into a significant portion of a freelancer's earnings, reducing the overall net income considerably.

The Unseen Downtime

Freelancers often face periods of downtime between projects when they are not actively working. This downtime is typically unpaid and spent searching for new opportunities. While permanent employees continue to receive their salaries during periods of organizational downtime, freelancers do not have that luxury. This lack of consistent income, coupled with the time spent on marketing, networking, and finding new clients, can result in a utilization rate well below 100%, further impacting a freelancer's earnings.

The Reality of Day Rates

To illustrate the impact of these factors, let's consider a freelancer with a day rate of 800 Euros and a utilization rate of 70%. At first glance, this may seem like a significant income. However, when we perform a simple calculation taking into account the unpaid time, social security expenses, and lack of benefits, the annual income derived from this calculation amounts to around 56,000 Euros. While still a respectable sum, it is important to recognize that this is not the same as accumulating substantial wealth, as the initial day rate might have suggested.

Final Thoughts

Freelancing, despite the allure of higher day rates, is not necessarily a pathway to instant wealth. The lack of benefits, responsibility for social security expenses, and periods of unpaid downtime all play a significant role in shaping a freelancer's actual earnings. It is crucial for both freelancers and employers to understand the true financial dynamics of freelancing and to consider these factors when entering into work arrangements.

Whether you are a freelancer or an employer, I would love to hear about your experiences in the world of freelancing. Feel free to share your thoughts and insights in the comments below.